Market Insight : China's Plug-In Hybrid Exports to the UK Skyrocket by 1,849%: A Manufacturing Triumph

Market Insight : China's Plug-In Hybrid Exports to the UK Skyrocket by 1,849%: A Manufacturing Triumph

Company Overview

Ticker TSLA represents Tesla Inc., a leader in electric vehicles and innovative automotive technology. The company is currently under focus due to surging export figures from China for plug-in hybrid electric vehicles, contributing notably to global market dynamics.

Technical Indicator Breakdown and Analysis (as of 2025-05-11)

- EMA 12: 279.024099 - The 12-day exponential moving average indicates the recent price trend and is currently higher than EMA 26, suggesting short-term momentum is positive. (EMA)

- EMA 26: 272.16395 - The 26-day EMA reflects a slightly longer trend and supports the current upward price movement. (EMA)

- MACD: 6.86015 - The Moving Average Convergence Divergence is positive, indicating bullish momentum. (MACD)

- RSI: 60.85042 - The Relative Strength Index is above 60, signaling moderately strong buying pressure but not overbought. (RSI)

- Bollinger Band Upper: 308.17997 - The upper band indicates the higher price volatility threshold, with the current close price nearing this band, suggesting the stock is approaching overbought territory. (Bollinger Bands)

- ATR: 17.59985 - The Average True Range shows moderately high price volatility today. (ATR)

- Volume: 132079700 - The trading volume is robust, supporting the price movement with strong market participation.

- Price Close: 298.26 USD - The latest closing price, reflecting a 4.72% increase from the previous close.

- Stochastic Oscillator Slow K: 88.62547 - Indicates strong upward momentum and nearing an overbought signal.

- Stochastic Oscillator Slow D: 82.94363 - Confirms the momentum trend, reinforcing potential continued strength.

Overall, the technical analysis indicators suggest a bullish trend for TSLA as of the date noted, with positive momentum and moderate volatility supporting a potential upward price movement.

Trend Sentiment: ▲ Bullish

Analyst Recommendation Trends

Strong Buy: 9

Buy: 21

Hold: 18

Sell: 9

Strong Sell: 3

Analyst sentiment is predominantly positive toward TSLA, with a combined 30 recommendations for strong buy and buy outnumbering hold and sell advisories, indicating confidence in the stock’s future performance.

Sentiment from Recent News

Overall Sentiment: Neutral

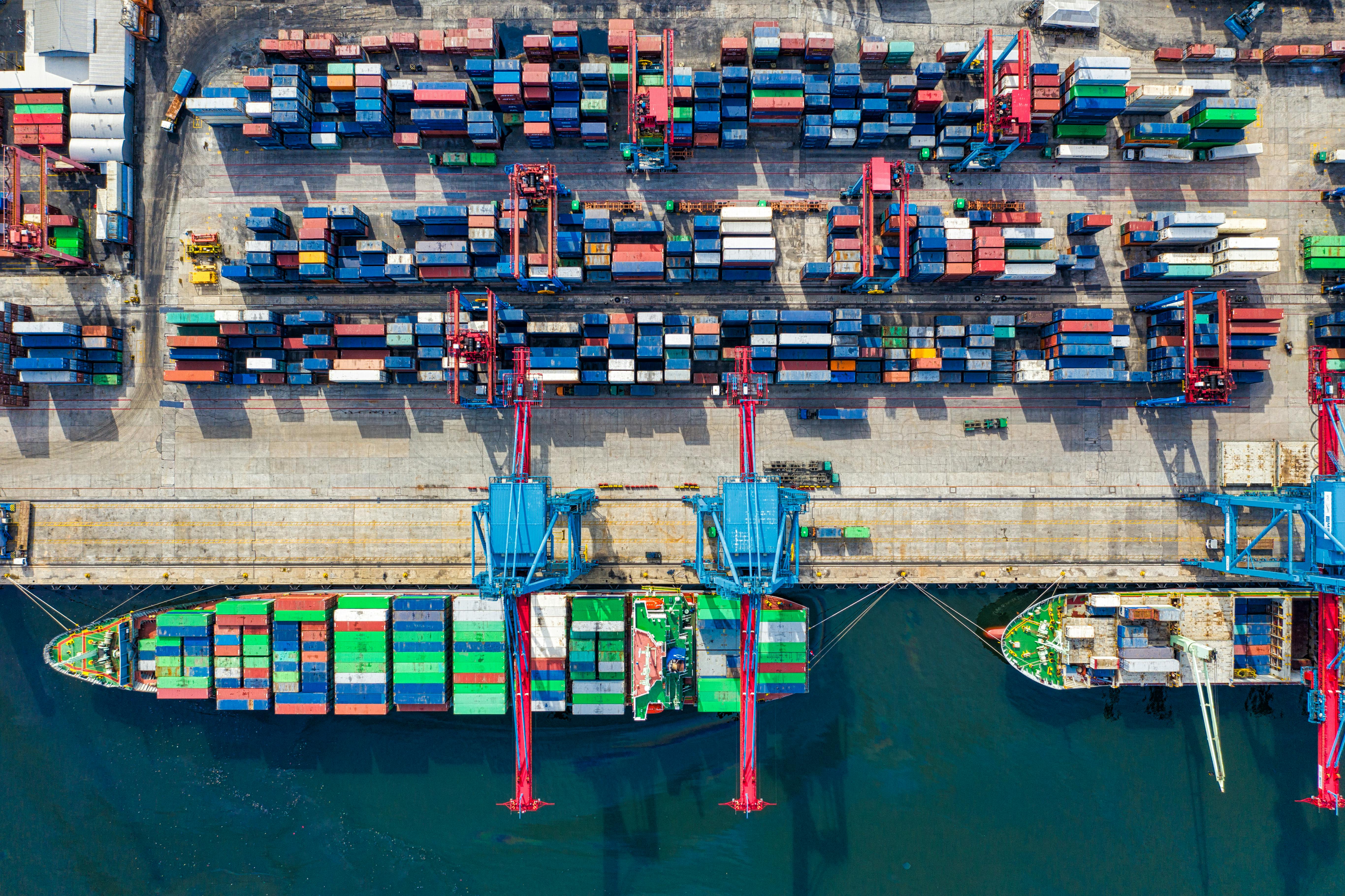

The recent news highlights a substantial 1,849% increase in China's plug-in hybrid vehicle exports to the UK, reflecting a manufacturing boost. Despite this growth, sentiment remains neutral given broader economic variables and ongoing challenges mentioned in headline critiques of Tesla’s operational plans.

Market Impact from Sentiment News

The neutral sentiment from recent news suggests cautious optimism in the market. While export figures are impressive, ongoing skepticism, especially regarding Tesla's robotaxi economics, tempers enthusiasm. Market participants are likely balancing strong growth indicators against potential cost concerns.

Summary

The recent surge in China’s plug-in hybrid exports to the UK has notably impacted the market perception of the involved stocks, including TSLA. Combined technical analysis indicates a bullish outlook supported by robust volume and momentum indicators. Analyst recommendations broadly favor buying, enhancing confidence despite balanced news sentiment. Investors should consider these multifaceted insights when evaluating TSLA’s position amid evolving market conditions.

This article is for informational purposes only and is not investment advice.

Comments

Post a Comment