Market Insight : China's Plug-In Hybrid Exports Surge by 1,849% to the UK: A New Trend in Green Manufacturing

Market Insight : China's Plug-In Hybrid Exports Surge by 1,849% to the UK: A New Trend in Green Manufacturing

Company Overview

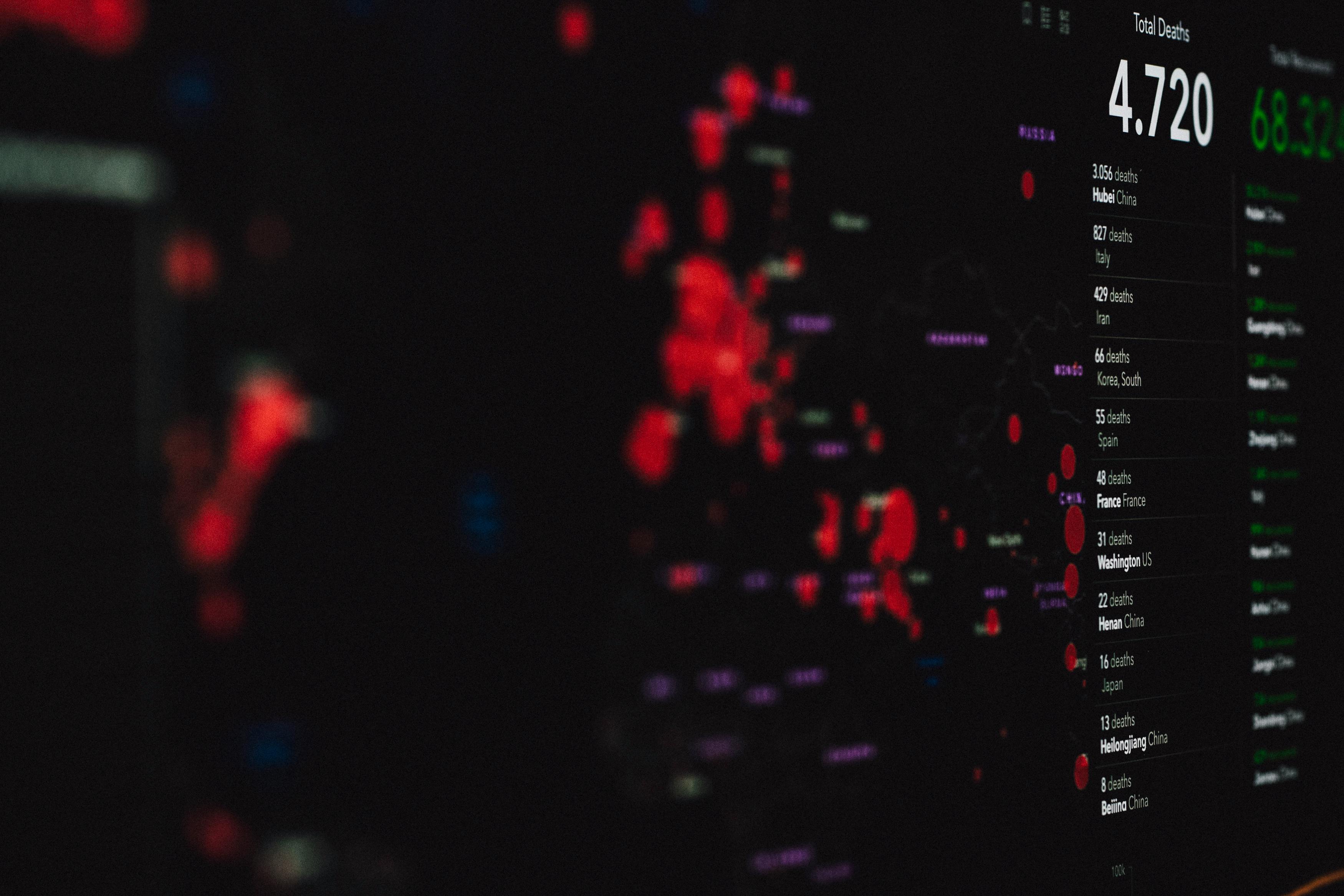

The recent analysis offers an insightful view into China's explosive growth in plug-in hybrid exports to the UK, marking a significant development in green manufacturing. China exported 3,898 hybrid electric vehicles (EVs) to the UK in March alone, representing a remarkable year-on-year increase of 1,849%. This surge highlights China's expanding footprint in the EV market and its emerging role as a critical supplier of sustainable transportation solutions to international markets.

Technical Indicator Breakdown and Analysis (as of 2025-05-11)

EMA12: 279.024099 – The 12-day Exponential Moving Average indicates the short-term price trend, currently showing a solid upward movement.

EMA26: 272.16395 – The 26-day EMA smooths out price changes over a longer duration and is below EMA12, suggesting bullish momentum.

MACD: 6.86015 – The Moving Average Convergence Divergence is positive, signaling upward momentum in the stock price; see MACD.

RSI: 60.85042 – The Relative Strength Index above 60 indicates moderate buying pressure; consider reading more about RSI.

Bollinger Band Upper: 308.17997 – The upper Bollinger Band shows a potential resistance at this level; Bollinger Bands help gauge volatility.

ATR: 17.59985 – The Average True Range reflects volatility in the stock price with moderate daily price fluctuations; learn about ATR.

Stochastic Oscillator Slow %K: 88.62547 – This high value suggests that the stock is nearing an overbought condition, which could indicate a potential pullback.

Stochastic Oscillator Slow %D: 82.94363 – The %D line confirms the %K’s overbought levels indicating strong recent price momentum.

Volume: 132,079,700 – High trading volume confirms strong investor interest.

Summary: The combination of rising EMA lines, a positive MACD, RSI above 60, and strong volume indicates a bullish technical trend, though the elevated stochastic oscillator warns of possible short-term overbought conditions.

Trend Sentiment: ▲ Bullish

Analyst Recommendation Trends

Strong Buy: 9

Buy: 21

Hold: 18

Sell: 9

Strong Sell: 3

The analyst consensus leans predominantly towards bullishness, with a strong majority recommending buy and strong buy ratings. However, there is a notable number of hold ratings and some sell signals revealing market caution and the presence of mixed views on the stock's near-term prospects.

Sentiment from Recent News

Overall Sentiment: Neutral

Recent news reflects a neutral sentiment overall, with no strong positive or negative biases dominating the market discourse. Coverage includes critical perspectives on Tesla’s robotaxi economics but also highlights significant export growth in China's plug-in hybrids. Market watchers are advised to monitor upcoming developments closely given the balance in sentiment.

Market Impact from Sentiment News

The neutral sentiment suggests that while new developments impact stock prices moderately, no dramatic movements are expected imminently. Investors may perceive risks balanced with opportunities, especially in companies involved in green vehicle manufacturing such as Tesla (TSLA) and Chinese exporters. This balanced outlook could mean cautious positioning and prudent market adjustments in the near term.

Summary

The surging exports of plug-in hybrids from China to the UK underscore a vital shift toward sustainable manufacturing and expanding global reach. The recent news landscape remains neutral, moderating the enthusiasm generated by robust export growth. Technical indicators and analyst recommendations paint a predominantly bullish picture, though tempered by cautious sentiments present in the overall market perception. Combining these insights, investors should remain optimistic but vigilant as evolving market and global economic factors continue to influence stock performance.

This article is for informational purposes only and is not investment advice.

Comments

Post a Comment