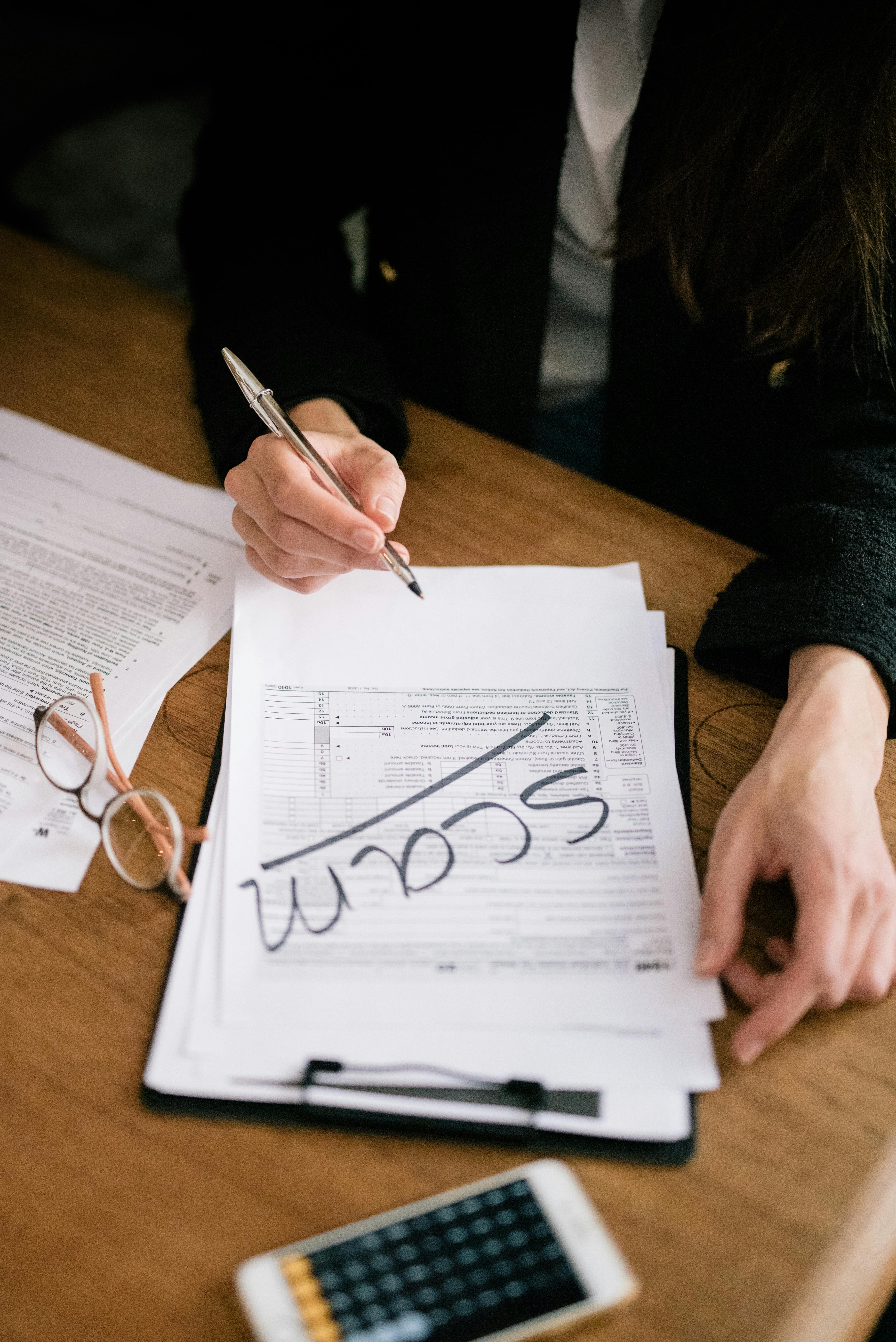

Market Insight : FBI Warns as Fake Law Firms Scam Crypto Victims: Beware New Schemes Targeting Past Losses in 2025

Market Insight : FBI Warns as Fake Law Firms Scam Crypto Victims: Beware New Schemes Targeting Past Losses in 2025

Company Overview

Tesla Inc. (Ticker: TSLA) is a leading manufacturer of electric vehicles and energy solutions. Recently, Tesla’s CEO Elon Musk made headlines for donating $15 million to pro-Trump political action committees just days before announcing plans for a third-party bid. This unexpected move adds political intrigue to Tesla's public perception as it continues to innovate in the automotive and energy industries.

Technical Indicator Breakdown and Analysis (as of 2025-08-14)

EMA 12: 327.39 – The 12-day Exponential Moving Average indicates recent price trends and suggests short-term momentum.

EMA 26: 322.99 – The 26-day EMA reflects a slightly longer-term trend, useful in identifying market direction changes.

MACD: 4.41 – The Moving Average Convergence Divergence value above zero implies upward momentum in the stock price.

RSI: 55.02 – The Relative Strength Index near 50 suggests the stock is neither overbought nor oversold, indicating a balanced market sentiment. (Learn more about RSI)

Price Volume: 1,036,656 – Trading volume indicates liquidity and interest in the stock.

Closing Price: $331.43 – The latest completed trading price.

Price Change: -$7.95 (-2.34%) – A moderate daily price decrease indicating recent downward pressure.

Bollinger Bands Upper: 346.02 – This upper band represents resistance and potential overbought levels.

Bollinger Bands Middle: 323.08 – The middle band is a simple moving average used to identify trend direction.

Bollinger Bands Lower: 300.14 – The lower band identifies support and potential oversold price zones.

ATR: 12.75 – The Average True Range measures market volatility; a higher ATR indicates larger price swings. (Learn more about ATR)

Stochastic Oscillator Slow K: 65.95 – Reflects momentum and potential price strength.

Stochastic Oscillator Slow D: 78.43 – A smoothed version indicating possible trend changes.

Overall, the technical indicators present a technical analysis picture that is mostly neutral to slightly bullish, with momentum indicators positive but price change recently negative. The stock price is near the Bollinger middle band, suggesting consolidation.

Trend Sentiment: → Neutral

Analyst Recommendation Trends

Strong Buy: 8

Buy: 19

Hold: 23

Sell: 8

Strong Sell: 3

The analyst consensus on Tesla is moderately positive, with a combined total of 27 recommendations leaning towards buying (Strong Buy + Buy). However, the significant number of Hold ratings suggests caution, reflecting uncertainty in the current market environment. Sell ratings are comparatively low but non-negligible, indicating some bearish sentiment among analysts.

Sentiment from Recent News

Overall News Sentiment: Bearish

Ticker Specific Sentiment:

- TSLA: Neutral

The recent news highlights cybercriminals impersonating lawyers and government officials to scam past cryptocurrency victims, as warned by the FBI. While the news sentiment is somewhat bearish due to increased risks and fraudulent schemes in the crypto market, Tesla’s stock remains unaffected directly with a neutral sentiment, keeping focus on its core automotive and energy business rather than crypto exposure.

Market Impact from Sentiment News

The bearish tone in the cryptocurrency-related news may create caution among investors globally, potentially affecting stocks associated with crypto projects or blockchain technologies. However, Tesla’s neutral ticker sentiment suggests its market impact is limited, maintaining steady interest despite external market fears. The technical and analyst data together support a cautious yet stable outlook for Tesla in this mixed environment.

Summary

Recent news of fake law firms scamming cryptocurrency victims introduces a bearish cloud over crypto markets but bears limited effect on Tesla's stock, which remains neutrally poised. Investor perception is characterized by moderate optimism mixed with caution, as evidenced by the balanced analyst recommendations and neutral technical indicators. The combined insights suggest that despite external headwinds in crypto, Tesla maintains resilience backed by its strong market presence and innovative initiatives.

This article is for informational purposes only and is not investment advice.

References

- Market Insight : Elon Musk's Major AI Announcement at Tesla Creates Bullish Waves for Nvidia Stock Investors - Find Out Why!

- Market Insight : Xiaomi's Electric Vehicles Surge in Popularity in China Leading CEO to Suggest Alternatives Amid Tesla Tension

- Fake Law Firms Targeting Crypto Scam Victims, FBI Warns - Decrypt.co

- Relative Strength Index - RSI (Investopedia)

- Technical Analysis (Investopedia)

Comments

Post a Comment